In the 1992 presidential election, Jame’s Carville, who was the campaign manager for Bill Clinton, came up with the slogan “It’s the economy, stupid” to remind the staff that the state of the economy was the most critical issue for voters. Ever since, this statement has been used in various forms to help clarify complex situations to one main point.

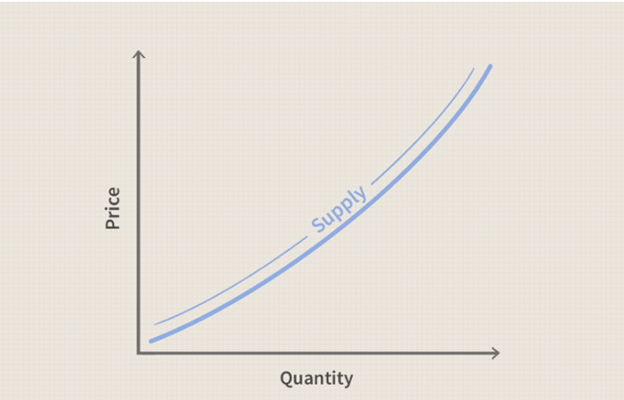

With all the talk about the affordability of housing and the many strategies that have been proposed to make housing more affordable, I thought the statement “It’s the Supply, Stupid” accurately illustrates the real problem and ultimate solution to the housing issue.

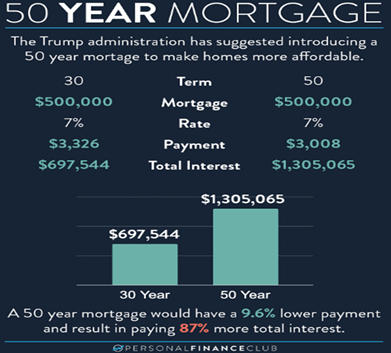

One solution that was recently proposed by the administration is to begin offering a 50-year mortgage. As the graphic below shows, this solution does lower the cost of a monthly payment by approximately 10% but it also increases the amount of interest paid over the life of the mortgage by 87%! One of the great benefits of a 30-year mortgage is that an individual can purchase a home when they are 30 and by the time they are ready to retire, they will have the mortgage fully paid. With a 50-year mortgage, there is a good chance they will never have their mortgage paid off. This solution does not fix the problem but merely provides a band aid that may cause more problems. One of these additional problems is that buyers will likely start raising their price offers on houses and it is possible that prices may rise enough to offset much of the benefit of the 30-year mortgage. From a societal perspective, it will simply increase the size of mortgage loans on everyone’s net-worth statement.

Another solution that was recently proposed by New York City mayor elect Zohran Mamdani is to freeze apartment rental rates. This solution really doesn’t provide any relief since current renters will not benefit since rates will be frozen at the current levels, which are unaffordable for many people. It could make matters worse over time since builders will not be incentivized to build if they know their rents will be capped.

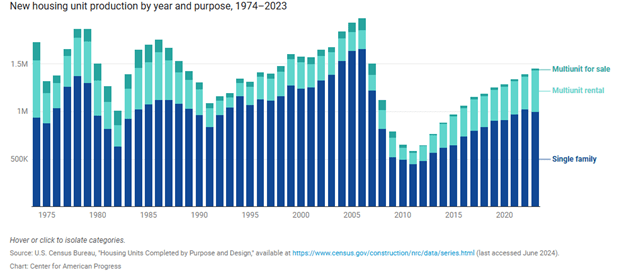

I think the chart below really sums up the lack of housing supply and the root cause behind this problem. The chart shows the number of new housing units coming on the market since 1975. Although we have come out of the low levels of 2010, we are still well below the long-term averages. To help put things in perspective, in the 1970s we had 120 million few people living in the U.S., but the amount of new apartment and home construction was above our current levels.

As with most things in economics, if the correct incentives are in place, it will drive the correct behavior from people and companies. The two main reasons behind housing affordability are the dramatic increases in building supply costs and lack of sufficient housing supply. These are both supply issues that can be fixed by implementing the correct incentives to have builder increase supply, streamline the regulatory process for the building process and find ways to lower building supply costs. Until these issues are addressed, we will continue to have a housing affordability issue.

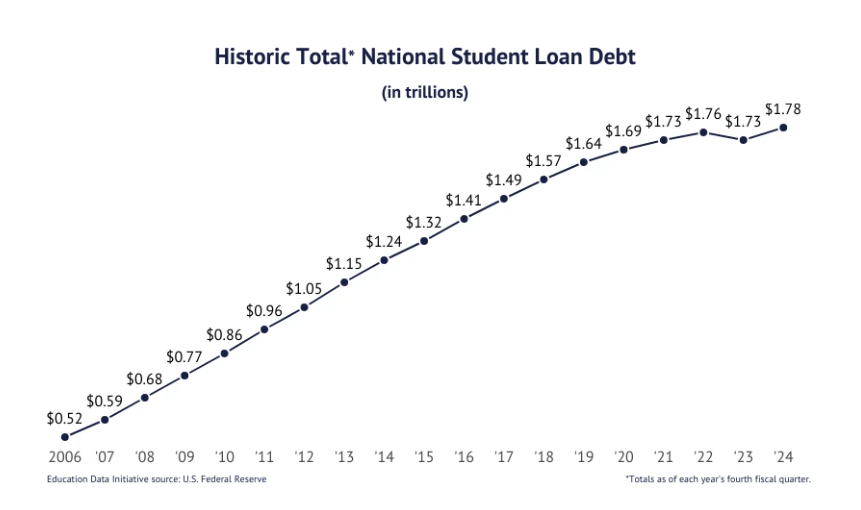

As an economist, I always strive to be balanced with my analysis so in that vein, I do need to highlight two issue that are a burden to potential buyers and what they can afford. The first is the stagger level of college debt. As the graph below shows, that amount has increased almost four fold in the past 20 years and the average debt level for recent undergrads is almost $40,000.

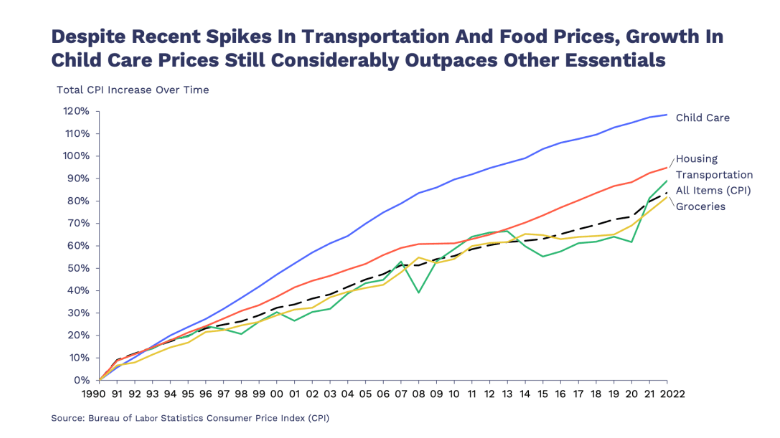

The second issue is child care costs. As the graph below shows, this expense has increased by more than all other household expenses and in many cases can prevent families from having both spouses work.

Both of these items limit the housing and mortgage expense families can handle and make the affordability issues caused by the limited housing supply that much worse.