In 1996, I was 4 years into my professional career and just received a promotion, moving to Winstar Communications in their marketing department. It was a job and company I was very excited about as it was launching telecom services in cities across the country, and I was on the team driving the implementation. I remember having some concerns because it was a publicly traded company that was losing money and Federal Reserve Chairman Alan Greenspan had just made an announcement that the stock market was showing signs of “irrational exuberance” .

Fast-forwarded to mid-2000 and I was now the finance person leading the roll out of international services for Winstar. I was continuing to love working at the company and my expanding responsibilities. It was also around this time that the little voice inside my head was getting concerned about the business environment. I was at a retreat with many of the company executives where a significant part of the conversation was about buying and selling large amounts of bandwith to other telecom providers and with our equipment vendors who were also financing the equipment sales. Although I had less than 10 years of business experience, this business model did not seem sustainable. Needless to say, my internal voice was accurate and within 9 months, Winstar was bankrupt, and I was out of a job in a year. This was also a period of time where the market dropped for 2.5 years until it hit it’s low in October of 2002.

In the past several months there have been many headlines about a bubble in the markets and the potential of a sharp market correction. It is similar to the many forecast calls of an imminent recession over the past few years. The question becomes, is the current environment more like 1996 where things are frothy but where the market continues to move higher for many years or are we in a period similar to the 2000 where the markets and the economy are entering a correction phase.

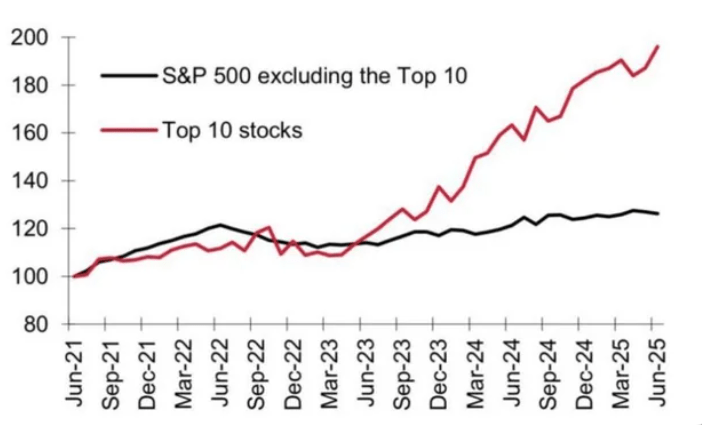

Let’s start with the positives that currently exist. The first is the performance and valuation of the bottom 490 companies in the S&P 500. As shown in the graph below, the vast majority of gains in the S&P 500 index can be attributed to the top 10 companies and these are the companies that have the higher valuations. With a forward PE of 22, the S&P 500 is well below the valuations of the 90s tech boom.

Source: Morgan Stanley

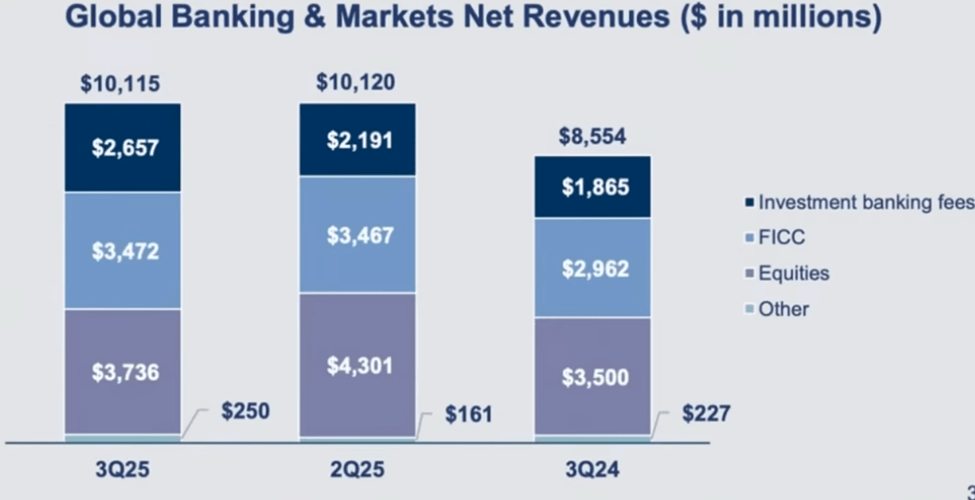

As shown in the graph below, the finance sector is booming which is a great sign for the economy. These companies are firing on all cylinders with increased revenue on lending, trading and M&A.

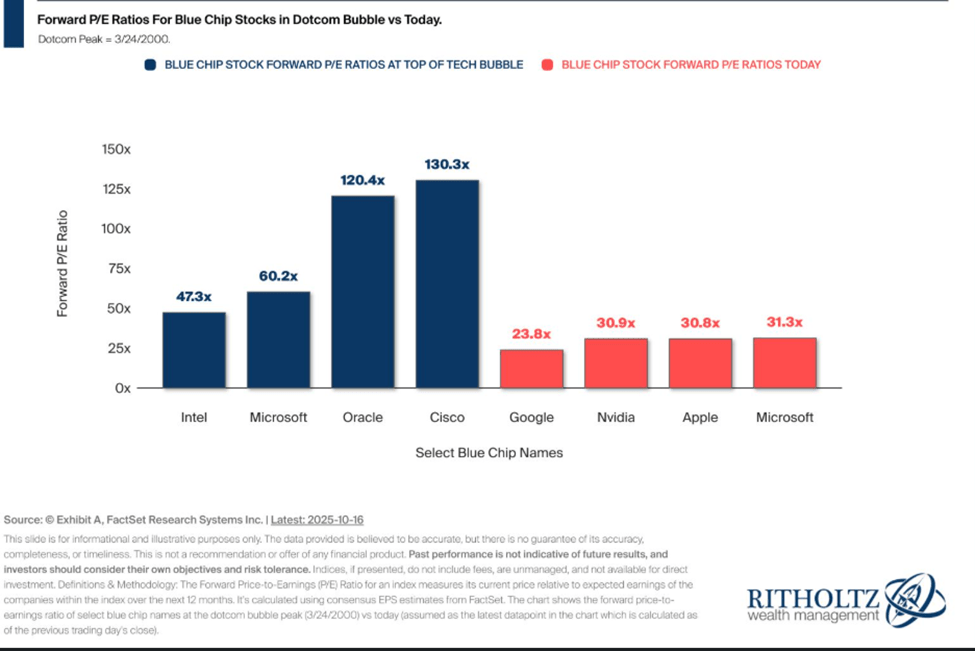

In the 90s tech bubble, many companies like QUALCOMM and Oracle had real earnings but a large percentage of the companies had negative earnings and were quickly going through cash. In this current market cycle, there are a few companies with negative earnings but the vast majority of companies have significant profit margins, growing earning and a tremendous amount of cash on their balance sheets. As the graphs below shows, this ever rising markets has been driven by continued increases in profits and valuations are reasonable versus the tech boom.

Finally, in 1999, interest rates were high, and the Fed was increasing rates, now we are in an environment where the Fed is lowering rates. This will stimulate the economy and allows for higher stock valuations.

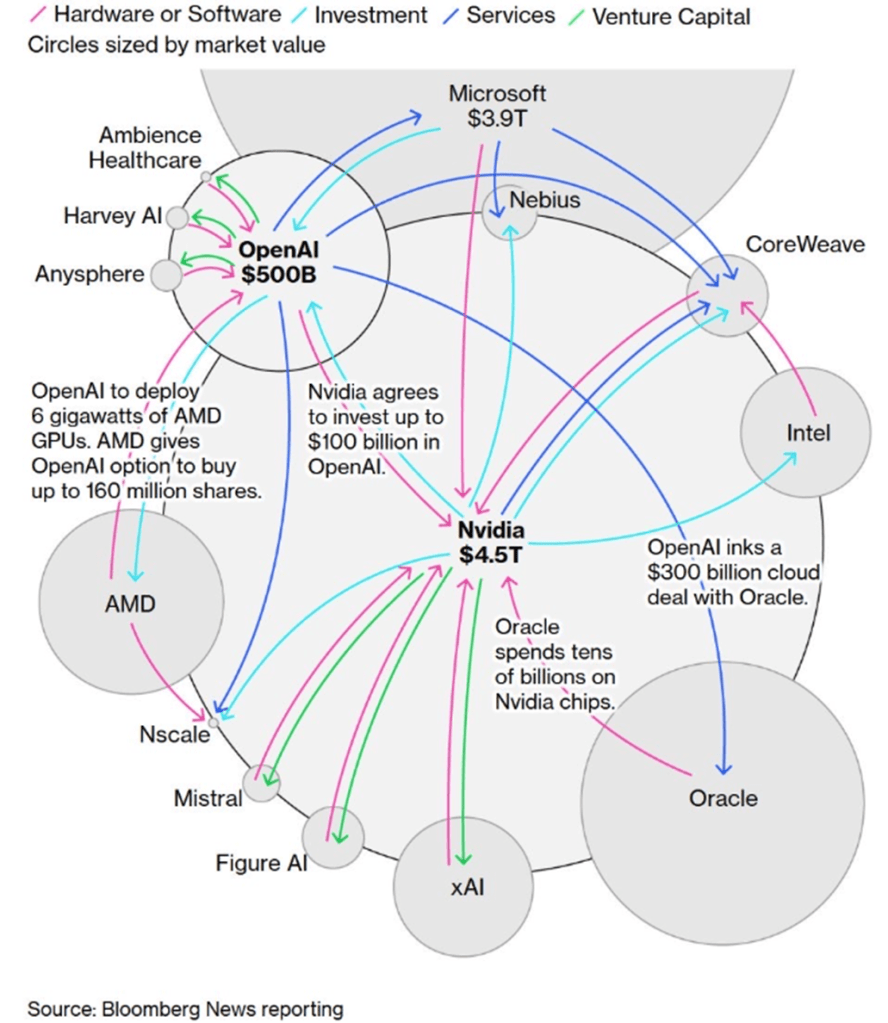

Now let’s exam the areas of concerns I have to start first with the graph below that shows how all the AI/tech companies are so intertwined with both investing in each other and revenue coming from each other. This is similar to my story about telecom companies not only buying from each other but also financing the purchases. This circular nature of an industry is never a great sign.

Source: JP Morgan

Another area of concern is the weakness of the labor markets. Consumers make up 75% of the economy and the data shows weakness in everything from hiring to fewer job openings. With the increase in unemployment we are also seeing increased defaults on car loans and higher credit card balances.

Finally, recently we’ve had a few fraud issues to come to our attention including the bankruptcy of auto parts provider First Brands Group. As JP Morgan Chase CEO Jamie Dimon stated, where there is one cockroach there are usually many.

So, considering all this data, how concerned am I about the market and the economy. First, it is very difficult to know and anyone who speaks with full authority is not being honest. With that said, if we follow a similar pattern to 1990s, I do feel like we have further for this market to run. Although things feel frothing, they don’t feel as crazy as they did in 1999 and given the momentum in this market and the huge opportunity with AI I don’t think we are in the height of the asset bubble. This doesn’t mean we won’t get there if the market continues to rally at this same rate.

I always remind clients that we live in a world in global risk and it’s important to make sure your portfolio lines up with your risk tolerance and cash flow needs. What this means is that you should take this opportunity to rebalance your portfolio to your asset class targets, raise cash for needs that will arise in the next couple of years, and adjust your allocation if your moving into retirement. Otherwise, having a long-term perspective and not trying to time the markets is still the best approach.