A question that I’m frequently asked is who exactly pays for the tariffs and how do they impact trade.

To start, the actual tariff is paid by the company that brings the goods through customs into the U.S. This is straightforward and is not up for debate. Where the uncertainty and variability begin from there is who shoulders these costs on an ongoing basis and how does this impact trading patterns. Below I have highlighted the different scenarios that can exist.

- The Supplier Pays – It is possible for the importing company to negotiate with the supplier. They can ask the supplier to reduce the costs of their goods to cover the full amount of the tariff. This is most likely to occur when there are multiple sources for the goods, including domestic sources.

- The Importer Pays – If the importer doesn’t feel as though they can negotiate with the supplier and the consumer will move to a different product or stop buying all together if prices are raised, then the importer with pay the tariff which will increase their costs by the full amount of the tariff. In economics, these types of goods are considered to be very price elastic. This scenario will occur where there are many importers of the good.

- The Customer Pays – If the goods are price inelastic, that means the full amount of the tariff can be passed onto the consumer and demand will not change. This scenario is likely where goods are very scarce and in high demand.

- Some Combination Pays – A likely option is that all three parties bear part of the tariff costs. Exactly how the tariff gets allocated between the parties will depend on multiple factors.

- Trade Gets Halted, Reduced or Moved – Finally, the implementation of the tariffs may completely change how or even if a product gets shipped into the country. One of the big determining factors will be how high the tariff is on that country. A very high tariff will cause the goods not to get shipped because there is too much uncertainty about whether the importer can bear the costs, or the consumer would purchase the goods at the higher amount.

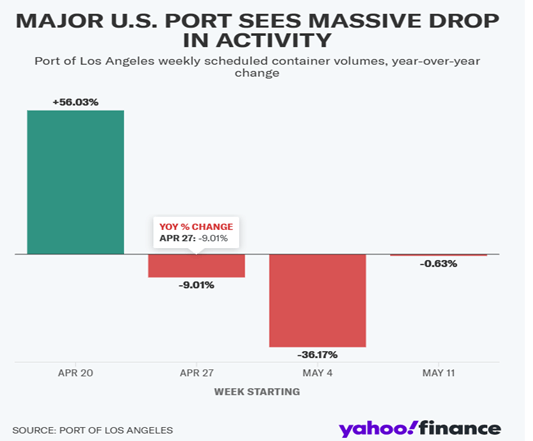

This type of reduction in goods being produced and shipped is already showing up in the data represented in the graph below that shows a massive drop in activity for the Port of Los Angeles.

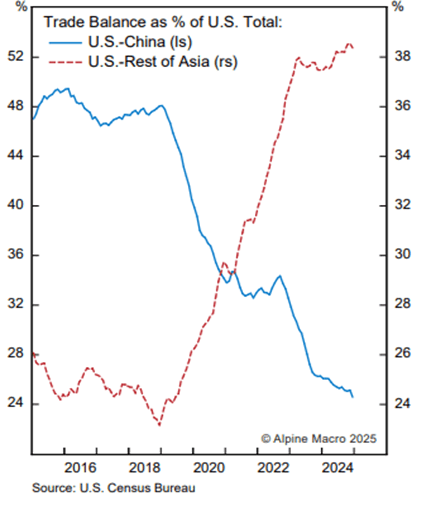

The other possibility is what we have seen since the Trump tariffs of 2018 and shown in the graph below where goods that were once manufactured in China are now manufactured in other countries such as Vietnam.

The biggest thing to appreciate is that given the complexity of international trade and the large role the U.S. plays in it, there will be many unexpected consequences from the tariffs and the longer the uncertainty exists around them, the bigger the impact they will have on the broader economy.