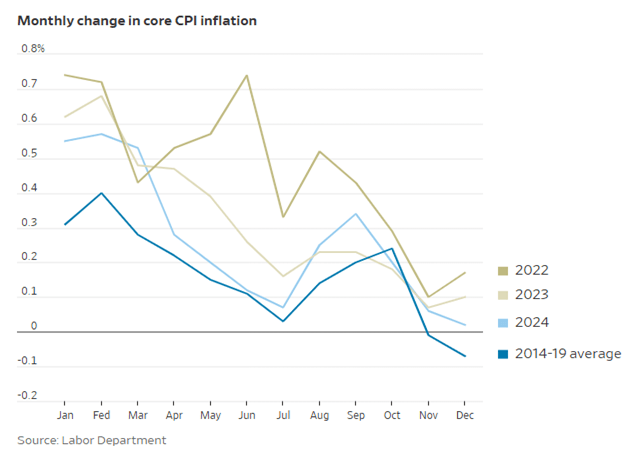

In economics, a single data point is typically not considered overly significant; instead, trends hold greater importance. Yesterday, the Bureau of Labor Statistics released January’s Consumer Price Index (CPI) data, which is not moving in the desired direction. The annual CPI increased from 2.9% in December to 3.0% in January, while the Federal Reserve’s target remains at 2.0%. Additionally, the month-over-month change was 0.5%, exceeding the forecast of 0.3%.

As illustrated in the graph below, January is usually the highest month for CPI. This year, January’s number will not decline from the previous year as it did in 2023 and 2024. This is why one month of data can matter—it often sets the tone for the year ahead. With this higher-than-expected CPI figure, it is likely the Federal Reserve will delay reducing interest rates until there is substantial evidence supporting such a move.

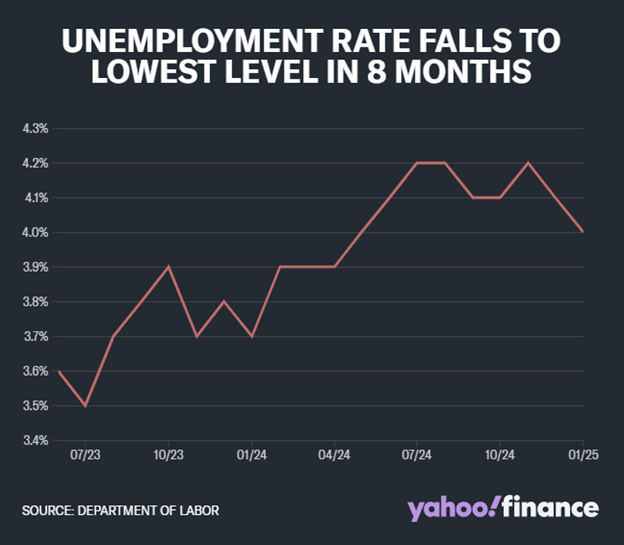

The Federal Reserve’s approach to adjusting the Federal Funds Rate considers its dual mandate: ensuring price stability (inflation at 2.0%) and maximizing employment. The second part of this mandate—employment—must also be taken into account when evaluating the Fed’s decision-making process for 2025. As the graph below illustrates, unemployment figures have risen from their extreme lows in 2023 but have since plateaued and are starting to decline.

Considering higher inflation and robust labor market conditions, it is highly probable that the Federal Reserve will maintain interest rates at their current level for the remainder of the year.

From an investor’s perspective, these factors contribute to the outlook for a strong economy and stock market performance. Rising consumer inflation expectations mean that companies can increase prices without significantly impacting consumer demand. This ability to raise prices enables companies to improve their profit margins. Furthermore, with higher interest rates, this is an opportune time to lock in long-term bonds, ensuring a strong yield for the next decade.