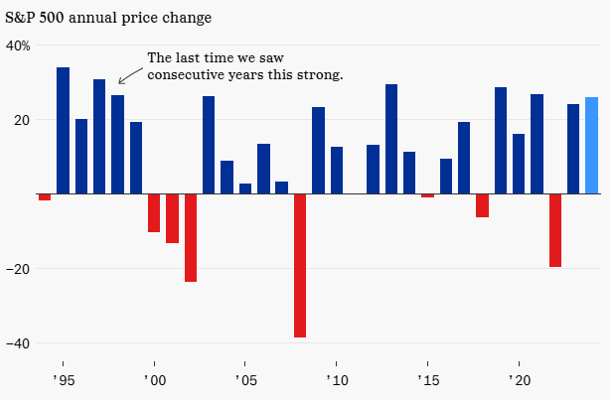

Barring any unexpected events between now and the end of the year, we are on track for the best two-year performance in the stock market since the late 1990s, as illustrated in the graph below. This raises the question: can the streak continue for a third consecutive year?

(Source: FactSet/Sherwood News)

Major financial firms have begun their annual ritual of releasing forecasts for 2025, and they are overwhelmingly bullish. A broad consensus predicts the market will rise by more than 20%, with the S&P 500 potentially reaching 7,000. However, given their historical track record, it might be prudent to approach such forecasts with skepticism. That said, several factors suggest the markets could at least yield positive returns in 2025.

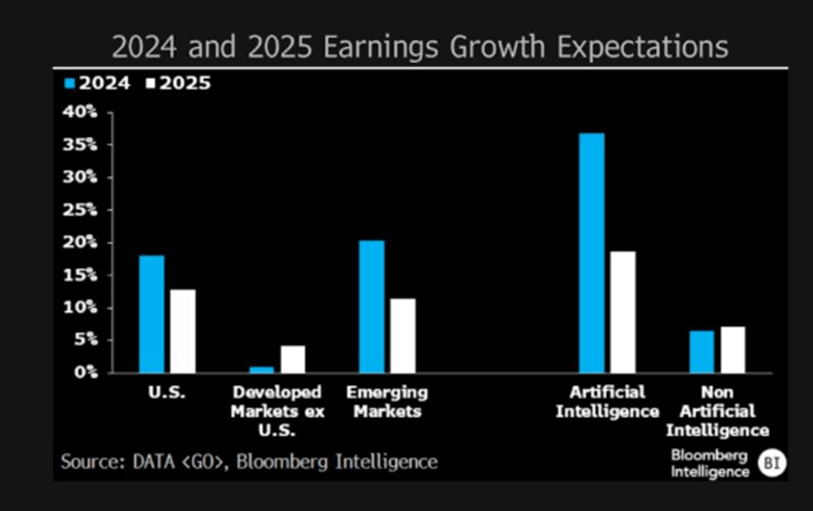

One significant driver is the continued growth of Artificial Intelligence (AI). Companies are heavily investing in AI technology while also reaping productivity and profitability gains from its implementation. As depicted in the graph below, earnings growth is expected to be robust in 2025, with AI serving as a primary catalyst. Additionally, a trend worth noting is the potential outperformance of small and mid-cap stocks. This trend has become evident in recent months, as the Russell 2000 (small caps) has gained 8.25%, compared to a 4.36% increase in the S&P 500.

The dominant theme in 2023 and 2024 has been a steady decline in inflation toward the Federal Reserve’s 2.0% target, accompanied by strong GDP growth, a resilient labor market, and sustained consumer spending. This “soft landing,” orchestrated by the Federal Reserve, was deemed unlikely by many economists. Remarkably, the Fed has raised interest rates by 500 basis points over 18 months without triggering a recession, a rare feat.

Investor sentiment has clearly turned bullish, and this momentum could persist for some time. However, it is essential to acknowledge potential risks, including geopolitical tensions and the rising national debt, which could lead to spikes in market volatility. Another concern is that stock valuations continue to exceed long-term averages. As shown in the graphs below, every industry sector is currently valued above its historical norm.

(Source: FactSet)