On any given day, an economist or stock analyst might be forecasting their expectations for the markets and specific sectors. While their analysis can be interesting and sometimes helpful for managing portfolios, most forecasts have limited value. The challenge is that the ability to consistently forecast accurately is very low. For every time an analyst is correct, there are just as many, if not more, times they are wrong. It’s hard to believe, but a stock or economic forecaster can make a weather forecast look like a rock star.

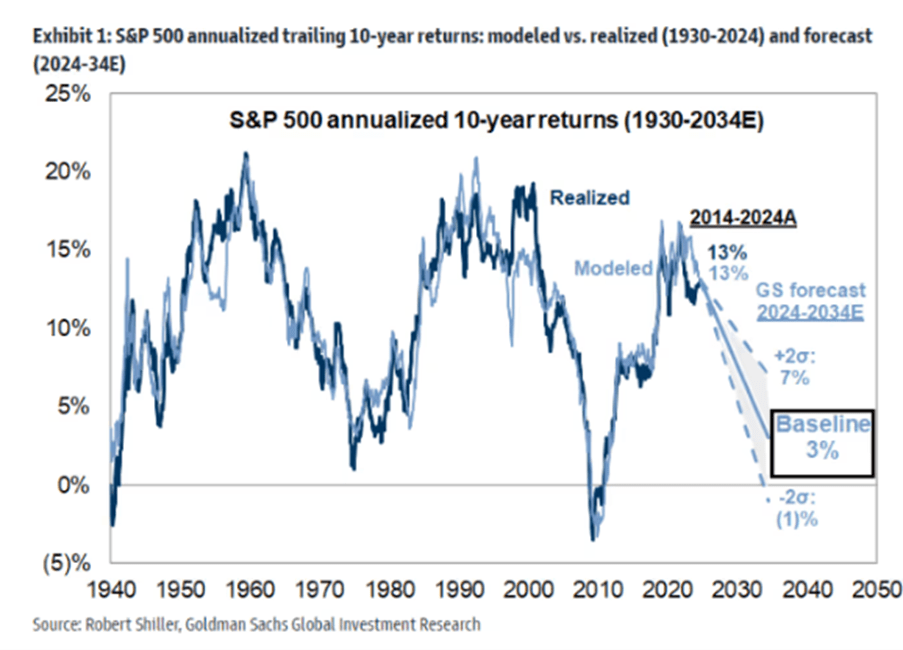

Recently, several investment firms, including Goldman Sachs, have issued forecasts predicting that the S&P 500 index will perform well below its historical average of 9–10% over the next decade. The degree of expected underperformance varies by firm, with Goldman being one of the most conservative, projecting a 3% annualized return for the next 10 years (illustrated in the graph below). These estimates are based on several factors, including current market valuations and the concentration of market value within the top 10 companies in the S&P 500 index.

There’s a reasonable chance, however, that these outlooks could be off the mark, possibly due to advancements like artificial intelligence and continued global economic growth. We could experience another decade of average or even above-average returns. That said, I think the following points can be gleaned from these forecasts:

- Rotating Asset Class Performance

The top-performing asset class over the past 15 years has been large-cap growth, outperforming every other asset class by a significant margin. This outperformance is the main reason the S&P 500 index has been one of the top-performing indices during this period. It’s entirely plausible that, over the next decade, the S&P 500 could perform below its historical average while other asset classes—such as international, small-cap, and mid-cap stocks—do very well. - The Law of Averages

Given the S&P 500 index’s strong performance of 13–14% returns over the past 15 years, it’s likely that to maintain a long-term average of 9–10%, the next decade may need to see below-average returns. - Adjust Your Plan

Even if the S&P 500 performs below its average over the next decade, that doesn’t mean you shouldn’t hold it in your portfolio. It will still contribute to growth. However, you may want to reassess your asset allocation and ensure your financial plan is based on conservative growth estimates to account for potential underperformance.